Bitcoin, Gold, and Uranium… oh, my! How my flagship ETF portfolio BEAT the S&P 500 in 2024!

Plus, Irk's Shopping List for his 60+ Individual Stocks! | Issue #35

My Retirement ETF Portfolio is based in a Roth Individual Retirement Account (IRA). As a result all gains that come from this portfolio when I retire are paid out tax-free.

I do not offer financial advice, however I will say this, every single person under retirement age should max out their Roth IRA every single year! Since the contributions are always withdrawable without penalty, a Roth IRA can serve as an emergency savings account.

Additionally, since you’re not permitted to catch up more than one year at a time, younger investors who skip a year are missing out on potentially immense long-term gains if they don’t max out their IRA every year.

My Retirement ETF Portfolio is my second-largest portfolio, only smaller than my Investments in Play flagship portfolio. Additionally, since the portfolio is based in a Roth, it receives the maximum contribution annually meaning there are new funds always coming to work unlike my three publicly-traded stock portfolios which are all closed-funds to maintain their integrity.

How did my portfolio perform against the S&P 500 in 2024? It did well. Very well.

The primary goal for me when it comes to my actively-managed accounts is to outperform my benchmark index, the S&P 500. If I can’t earn greater returns than my benchmark, why waste all the time I spend managing my portfolios, right?!

Fortunately, my Retirement ETF Portfolio blew the doors off the S&P 500. Where the index returned a very impressive +24.01% (without dividends) for the year, my Retirement ETF portfolio trounced those returns with a +31.81% gain! That’s not including the additional $7,000 in contributions made each year, of course.

So, how did I do it?

What’s the investment strategy for this account?

Buying in Stages: Unlike my “Dumb Money” i401(k) Portfolio, I do time my buys for pullbacks in the underlying assets in this portfolio, identifying key areas of support where I’ll add to positions. For more details on how I identify buying price targets for my positions, check out my past post where I used Vanguard’s Total Stock Market Index Fund (VTI) as an example.

Since there’s always new money coming into this account (Roth IRAs currently allow contributions of up to $7,000 per year for those under 50 and $8,000 for those 50+), I am regularly raising my buying price targets to add to the underlying assets in earnest.Selling in Stages: Whereas I am regularly strategically buying and selling in stages in all three of my publicly-traded stock portfolios, I do not permit myself to sell in stages in this Roth account. A key priority is to have as much of the cash put to work at all times to operate on the “time in the market beats timing the market” principle. When I do trim positions in this account, it’s either because I’ve reallocated or it’s for a few key volatile positions (BND, CTA, HYG, and WGMI).

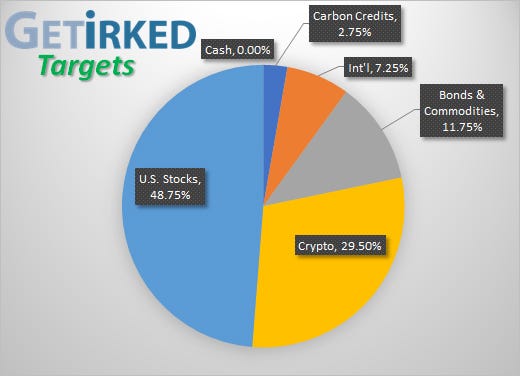

Retirement ETF Portfolio Allocation Targets

This portfolio seeks to diversify across asset classes and geographic areas with exposure to a wide variety of underlying assets. Naturally, the largest focus is the U.S. stock market, however I have also made cryptocurrency (Bitcoin, in particular) a significant focus of this portfolio, too.

I believe in the long-term prospects of Bitcoin, and, if the price targets some like Cathie Wood and Michael Saylor hold are to be believed, there is some significant upside in the future. However, while I do own spot Bitcoin, I have no intention of ever selling any of it. Instead, I chose to build exposure to Bitcoin in my Roth using the Bitcoin ETFs so I could one day capitalize on those gains tax-free when I need funds in retirement.

The remainder of the portfolio breakdown can be seen below starting with a chart of how I’ve targeted each of the five different sectors:

U.S. Stocks (48.75%): I use a total of four different ETFs to comprise my portfolio’s exposure to the U.S. Stock Market:

JEPI JPMorgan Equity Premium Income ETF (0.75%): Using options trading on the S&P 500, JEPI provides income in the form of a monthly dividend which I reinvest. Obviously, due to the small weight of this position at 0.75%, this is more experimental than for anything substantial.

VIG Vanguard Dividend Appreciation Index (10.50%): Unlike dividend-focused ETFs like Schwab’s SCHD, VIG buys companies who regularly increase their dividend. As a result, this ETF gets exposure to incredibly successful companies (they have to be in order to regularly increase their dividend), but does not have a particularly substantial yield since the underlying companies are regularly increasing in capital value. Still, an annual yield of 1.67% isn’t the end of the world.

VOOG Vanguard S&P 500 Growth Index Fund (15.25%): Unlike S&P 500 ETFs which seek to represent the entire index, VOOG focuses specifically on the high-growth companies inside the S&P 500. As a result, VOOG is typically more closely correlated to the Nasdaq than the S&P 500.

VTI Vanguard Total Stock Market Index (22.25%): The largest single ETF holding in the portfolio, VTI distinguishes itself from S&P 500 ETFs like SPY or VOO by buying every single stock in the U.S. stock market, nearly 3,600 individual stocks, by market cap.

Cryptocurrency (29.50%): I hold three different Bitcoin ETFs (which some may find odd but I explain why below) as well as an Ethereum ETF and a cryptocurrency miners ETF.

BITB Bitwise Bitcoin ETF (10.50%): The Bitwise Bitcoin ETF has the lowest expense ratio of all the available Bitcoin ETFs at 0.20%. As a result, I’ve allocated the largest portion of my crypto exposure to this ETF. However, since Bitwise is also a relatively new ETF company, I chose to add two (2) other Bitcoin ETFs as well.

FBTC Fidelity Wise Origin Bitcoin Fund (8.00%): Unlike BITB and IBIT which use Coinbase (COIN) to custody the underlying Bitcoin, Fidelity actually chose to custody its own Bitcoin for FBTC. As a result, I felt that diversifying into Fidelity’s Bitcoin fund was prudent even though I believe the likelihood of any of the ETFs losing their Bitcoin due a Coinbase hack to be remote.

IBIT iShares Bitcoin Trust (8.00%): Blackrock’s Bitcoin ETF will eventually have a somewhat higher expense ratio than BITB (currently at an introductory 0.12% for a few more months), the reason I own IBIT is due to Blackrock’s own reputation. Unlike Bitwise which is relatively new, Blackrock is the most substantial of the ETF creators in terms of financial heft meaning their ETF is the least likely to experience financial issues (again, a remote possibility).

ETH Grayscale Ethereum Mini Trust ETF (2.25%): Ethereum has been silver to Bitcoin’s gold in terms of cryptocurrency so when the Ether ETFs launched, I decided I did want some exposure. Obviously, I have less faith in Ether than I do in Bitcoin as I’m allocating 26.50% of the entire portfolio to the three Bitcoin ETFs and only 2.25% to Ethereum. The reason I chose Grayscale’s is that it has the lowest expense ratio of the entire family of Ether offerings (currently at 0.00% as an introductory price).

WGMI CoinShares Valkyrie Bitcoin Miners ETF (0.75%): The crypto miners are notoriously volatile. To make matters worse, which one is considered the “Best-in-Breed” seems to change on a nearly weekly basis, making selecting an individual stock extremely risky as what was last week’s winner may be next week’s loser.

Thanks to Caleb Franzen of Cubic Analytics identifying extreme underperformance in the sector in late 2023, I used WGMI to build exposure and now have a decent-sized position with absolutely no capital risk. As a result, the maximum allocation size for WGMI is a relatively small 0.75% since I have no intent of putting capital back into the position now that it’s “risk-free.” WGMI actually pays a dividend, too, believe it or not, although the yield is less than 0.20% annually.

Bonds & Commodities (11.75%): Inside this sector I hold exposure to a variety of eight (8) different bond and commodity ETFs (along with one gold mutual fund) with a specific focus on gold and spot uranium:

PHYS Sprott Physical Gold Trust (3.00%): I own exposure to gold for the same reasons I own exposure to Bitcoin. Now, while it may appear that my exposure is significantly less, that’s just this portfolio. I hold exposure to gold in other portfolios as well as a large amount of spot at the bottom of a lake somewhere.

The reason I use PHYS instead of the gold ETFs GLD or IAU is due to long-held rumors that the ETFs do not actually have the gold to back up their ETF values. As a result, GLD and IAU do not trade closely to the price of gold as they should whereas Sprott buys gold one-for-one and PHYS typically correlates much more closely to the price of the underlying commodity.GDX VanEck Gold Miners ETF (2.25%): I originally wanted to use the gold miners for my gold exposure because, unlike the yellow metal, the miners pay out dividends. However, the long-held belief that the miners will outperform when gold does well has proven to be a near lie. With gold trading near all-time highs, the gold miners are nowhere close with most 50% or more off their highs. Accordingly, I’ve been reducing my allocation to GDX and moving it to the Sprott Physical Gold Trust (PHYS).

SRUUF Sprott Physical Uranium Trust (2.25%): Just like their physical gold trust, Sprott buys actual yellow-cake uranium and stores it one-for-one in their SRUUF. As I believe the entire world will be switching to nuclear power for energy generation headed forward, I want a substantial allocation to SRUUF. For the moment, it’s just at 2.25% but I expect to reallocate more funds to SRUUF if uranium continues to pull back in 2025.

EPGFX EuroPac Gold Fund (1.25%): Peter Schiff’s own gold mutual fund, I originally opened a position in EPGFX back in 2021 with a much, much larger allocation. However, while the fund is managed by a truly stellar goldminer investor, the goldminers’ lack of performance made me dramatically reduce exposure to the EPGFX, as I now prefer to use Sprott’s Physical Gold Trust (PHYS) for my exposure to gold. As gold increases in value, I continue to reduce the allocation to EPGFX, moving that exposure to PHYS, instead.

BND Vanguard Total Bond Market Index Fund (0.75%): BND tries to provide exposure to the entire bond market. Since I’m not a huge fan of bonds, I keep the allocation to 0.75% with dividends reinvesting monthly.

CTA Simplify Managed Futures Strategy ETF (0.75%): CTA seeks to act like a Commodity Trading Advisor in an ETF wrapper. The underlying’s managers’ use futures contracts to adjust exposure to U.S. Treasurys, equities, commodities, and foreign exchange currencies. The fund tends to be fairly volatile which is why it has a small allocation, however it also sometimes pays substantial dividends with 2024 paying out more than 8.00%.

HYG iShares High Yield Corporate Bond ETF (0.75%): Referring to iShares’ fund as “high-yield” makes HYG sound more prestigious than it is. “High-yield” bonds used to be referred to as “junk bonds” because the underlying companies are higher-risk, which explains the small allocation size. However, my timing with HYG has been fantastic as I’ve been buying when it’s been hated and selling when it approaches resistance. I do not intend to have more exposure than 0.75% and use its monthly dividend to reinvest and grow the allocation slowly over time.

TLT iShares 20+ Year Treasury Bond ETF (0.75%): You’ve probably noticed that I have a significantly small exposure to bonds in this portfolio, a total of just 2.25% and that’s because, well, I just don’t care for bonds. That being said, I like buying them when they’re hated which is why I also have exposure to TLT.

Rather than buying actual U.S. Treasurys, using TLT allows for more liquidity as well as the ability to place standing limit orders instead of having to time my buying to the yields. When TLT sells off, the yield increases, so I use standing limit orders at extremely low prices to slowly build up exposure over time.

Like BND and HYG above, TLT automatically reinvests its monthly dividend to help increase the size of the position over time.

International Stocks (7.25%): I use three different ETFs to provide my portfolio with exposure to international markets. Despite the underperformance of international markets over the years, I feel some diversified exposure is still prudent so I have a total of 7.25% of the portfolio allocated to this international markets:

VWO Vanguard Emerging Markets Fund (3.00%): China, India, Israel, Brazil and many more countries are represented in VWO. Since I feel we could see significant growth from emerging markets headed forward, I have a decent amount of exposure dedicated to VWO.

VXUS Vanguard Total International Stock Index Fund (3.00%): Unlike Vanguard’s popular World Stock Market Fund (VT), VXUS has a key difference: it holds no U.S. stocks. Every single stock in VXUS is internationally-based making it a far more “accurate” choice for me when seeking international stock exposure. I already have plenty of U.S. company exposure in the rest of this portfolio so selecting an international ex-U.S. fund seemed appropriate.

EWZ iShares MSCI Brazil ETF (1.25%): While its inarguable that Brazil has been having a tough go of it of late, I do believe in the long-term prospects for this country so I have direct exposure to their market through EWZ. The companies in Brazil also pay substantial dividends with EWZ yielding more than 8.00% in 2024 alone.

Carbon Credits (2.75%): I stated buying carbon credits funds very early on. As a result, I have a lot of exposure with very little risk as I’ve trimmed profits near highs over the years. While not as popular now as they were four years ago, I do believe the world will continue using carbon credits as a way to offset carbon greenhouse production into the future. As a result, I hold two different funds in this portfolio to maintain a relatively small 2.75% maximum allocation to this unique sector that remains non-correlated to any other market:

KRBN KraneShares Global Carbon ETF (1.75%): KraneShares launched KRBN quite a bit later than GRN (see below) so I still have investment capital at risk and use KRBN as a way to build exposure to carbon credits since GRN is operating “risk-free.” A nice differentiating benefit to KRBN is that it often pays out a quite substantial yield (more than 3.50% this year) unlike GRN whose makeup makes yield payments nearly impossible.

GRN iPath Series B Carbon ETN (1.00%): I was so early buying GRN that the price positively skyrocketed from where I opened my position. As a result, I sold all of my original capital plus profits out of the position and keep the remainder as risk-free exposure to carbon credits.

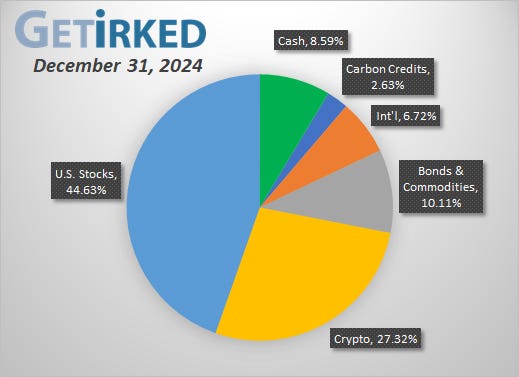

Retirement ETF Portfolio Current Allocation

All of the positions I’ve listed above include the maximum target allocation for each position, but I wouldn’t be able to add during pullbacks if I didn’t keep cash on the sidelines. As a result, while I always keep an eye on my ideal targets, I also like to have a decent-sized cash hoard.

Unlike my individual stock portfolios, I strive to keep a much, much smaller amount of cash in this portfolio, typically less than 10%. The reason for this is two-fold: (1) I want to have as much exposure to my underlying assets as possible and (2) there’s always new cash being infused into the portfolio so keeping a large cash position isn’t necessary.

With that being said, here’s what the current structure of the Retirement ETF Portfolio looked like on December 31, 2024:

One more portfolio to go!

There you have a breakdown of my Retirement ETF portfolio, my second-largest portfolio. Next week, we delve into my third and final ETF portfolio, the one I refer to as my “End of the World” ETF Portfolio. Stay tuned!

My Individual Stock Buy & Sell Targets

Premium Members: Read on to find my shopping list for each of my 60+ individual stock positions across my three publicly-traded portfolios: Speculation in Play, the Pandemic Portfolio, and, my flagship portfolio: Investments in Play.

Keep reading with a 7-day free trial

Subscribe to Get Irked - Teaching Long-Term Investing Success to keep reading this post and get 7 days of free access to the full post archives.