Bitcoin Price (in USD): $107,215.20

Weekly Change: +1.25%

Bitcoin Price Action

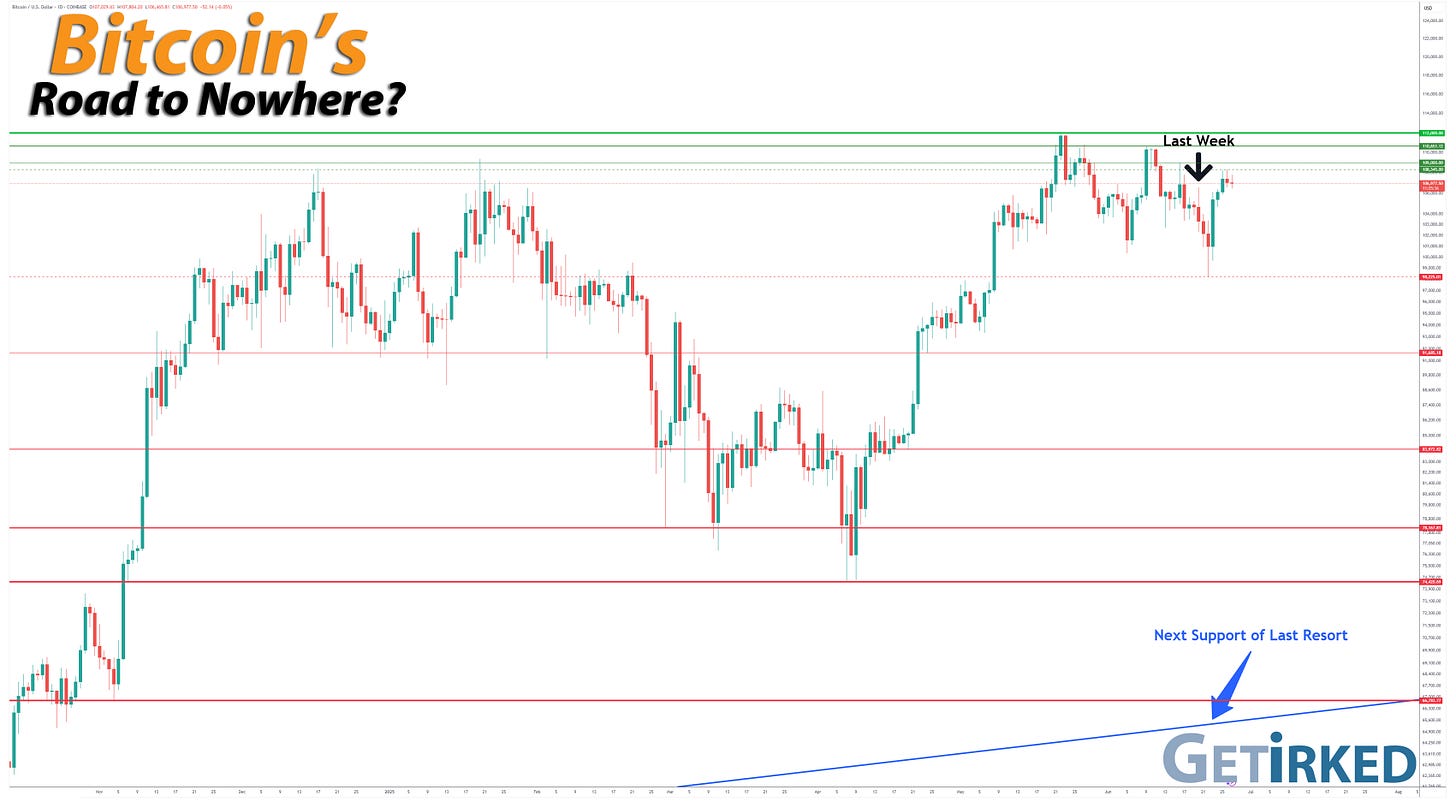

Following the United States’ attack on three nuclear enrichment sites in Iran on Saturday, Bitcoin broke through key weekly support and continued down further to crash through the $100K mark. The flagship cryptocurrency didn’t find new support until $98,225.01. Bitcoin’s price action indicates that is definitely not a safe-haven asset or “digital gold” as investors sold the crypto lower on the heels of heightened geopolitical risks.

Bitcoin made a remarkable recovery after the U.S. negotiated a ceasefire between Israel and Iran. However, Bitcoin failed to make a higher-weekly high, finding resistance at $108,345.00 on Thursday, just below our past high at $109,000.

The Bullish Case

Bulls point to Bitcoin’s quick recovery as proof that the crypto remains in a Bull Market. Despite the lack of a higher weekly-high, Bulls argue that the appetite for Bitcoin remains high across the investing landscape with predictions for new all-time highs coming in July.

The Bearish Case

Bears argue that Bitcoin’s inability to make a new higher weekly-high combined with weakness across the rest of the cryptocurrency market are signs of further weakness across the sector. Bears state that the break of $100,000 represents a significant sign of potential downside for Bitcoin, specifically, with some predicting the next level of support around $93,500 is very much in play over the coming weeks.

Key Selloff Targets

These key selloffs are derived from past pullbacks from all-time highs as well as various Crypto Winters:

-26.31% = $82,532.80

-30.27% = $78,097.60

-31.24% = $77,011.20

-31.95% = $76,216.00

-33.49% = $74,491.20

-37.63% = $69,854.40

-39.53% = $67,726.40

-40.24% = $66,931.20

-53.06% = $52,572.80

-62.91% = $41,540.80

-77.46% = $25,244.80

-84.36% = $17,516.80

Bitcoin Trade Update

Current Allocation: 8.500% (+8.52% since Last Update)

Current Per-Coin Price: $108,961.97 (-0.57% since Last Update)

Current Profit/Loss Status: -1.60% (+1.78% since Last Update)

When Bitcoin tested weekly support (which it eventually broke through), my buy orders started to get filled. I made a total of four (4) buys giving me an average price of $102,089.78 (after trading fees). The buys lowered my per-coin cost -0.57% from $109,589.81 to $108,961.97 and raised my allocation +8.52% from 7.883% to 8.500%.

Since I started this trade on May 25, 2025, my approach to buying in stages during selloffs has lowered my per-coin cost a total of -2.713% including trading fees!

Despite Bitcoin breaking through the $100K support level by quite a margin, I will return to adding above $100K at key levels. As long as Bitcoin is testing support under my cost basis, any purchase I make lowers my cost basis so it’s a win! Of course, I will continue to use the same quantity size above $100K; that won’t increase until and unless buy orders start filling under $100K. 😀👍

My Next 30 Bitcoin Buy Targets

Premium subscribers to Get Irked get access to my next thirty (30) … yes, 30 … buys in Bitcoin including price levels and quantities. Additionally, premium members get exclusive access to Microsoft Excel and Google Sheets version of my Bitcoin Trading Calculator.

I also include a tutorial video on how I execute my Trade2HODL strategy that I developed to accommodate crypto’s incredibly volatility after the 2018 crash which has never had a losing trade in more than 150+ trades since I started using it.

Keep reading with a 7-day free trial

Subscribe to Get Irked - Teaching Long-Term Investing Success to keep reading this post and get 7 days of free access to the full post archives.