*HALF-TIME REPORT* How My Youngest Portfolio Beat the S&P 500 YTD by 2X With a 41%+ Cash Position!

Pandemic Portfolio #66 | June 27, 2025

What is the “Pandemic Portfolio?”

Back in May 2020, I decided to create an all-new portfolio, one that was designed with a specific type of diversification with a broad range of asset classes and sectors. The idea was to create a portfolio that could weather recessions, Black Swan Events, and market downturns.

The name, obviously, had to be the “Pandemic Portfolio.”

Since starting in the throes of COVID-19 in 2020, I have regularly had to implement different strategies to get this portfolio to work. Initially, many “experts” believed we could retest the March 2020 lows, so, unfortunately, I didn’t put as much cash to work as I should have. As a result, the Pandemic Portfolio typically underperforms the S&P 500 during bull rallies, making less gains than the benchmark. However, with an absolutely enormous cash position, the Pandemic Portfolio does dramatically outperform the S&P 500 during pullbacks.

Last year, I implemented a strategy to aggressively put more money to work faster, and, as a result, the Pandemic Portfolio has made a full turnaround this year. Like the Investments in Play portfolio, my Pandemic Portfolio has been outperforming both on the upside as well as the downside in 2025.

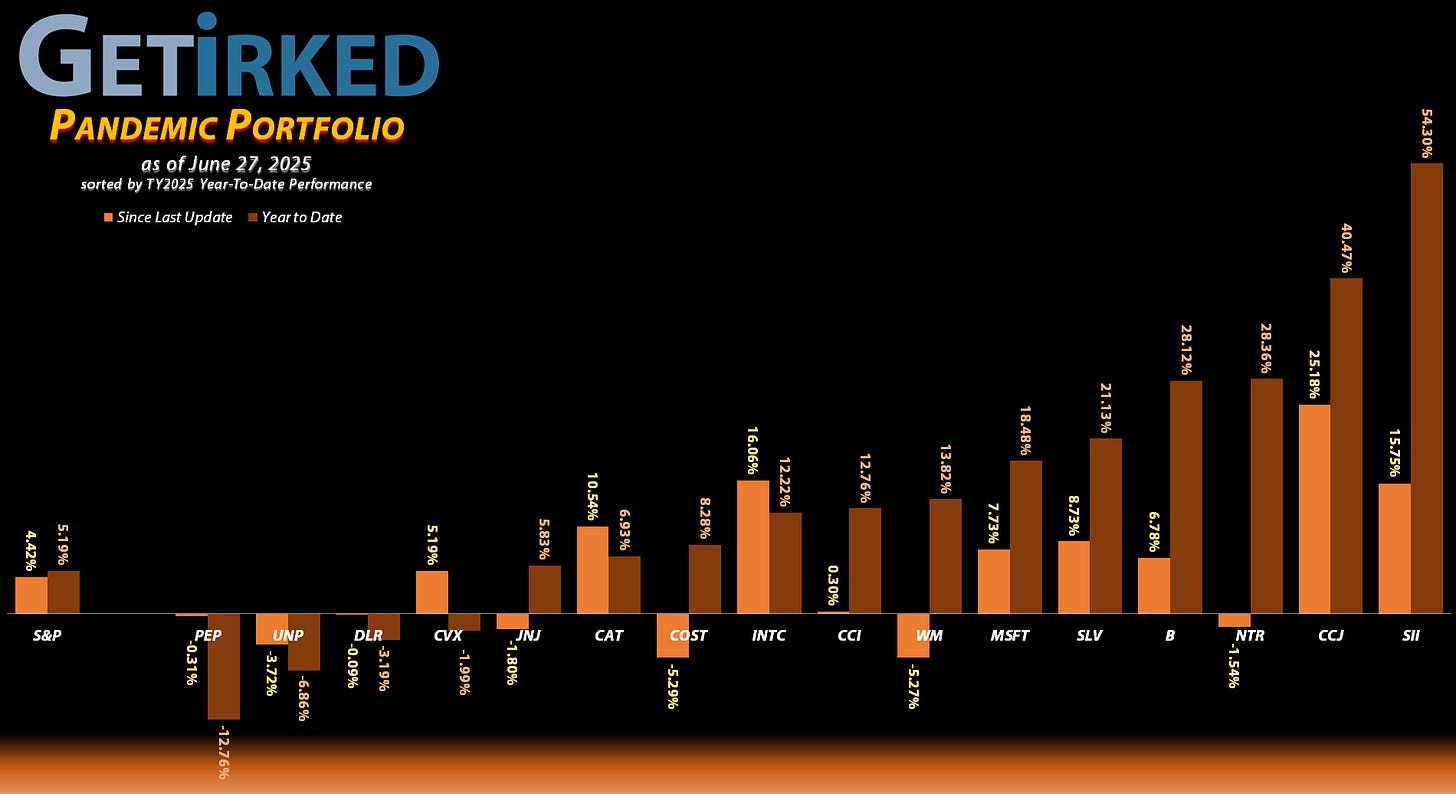

5 Best Performers Year-To-Date

5th Best: iShares Silver ETF (SLV): +21.13%

4th Best: Barrick Gold (B): +28.12%

3rd Best: Nutrien (NTR): +28.36%

2nd Best: Cameco (CCJ): +40.47%

1st Place: Sprott (SII): +54.30%

5 Worst Performers Year-To-Date

5th Worst: Johnson & Johnson (JNJ): +5.83%

4th Worst: Chevron (CVX): -1.99%

3rd Worst: Digital Realty Trust (DLR): -3.19%

2nd Worst: Union Pacific (UNP): -6.86%

WORST: PepsiCo: -12.76%

Comparison to the S&P 500

Even with the Pandemic Portfolio overweight cash to the tune of a 41.18% cash position, the portfolio positively trounced both of my other individual stock portfolios and absolutely destroyed the S&P 500 by the end of half-time!

Thanks to its exposure to both precious metals and nuclear energy (as well as the surprise boost from agriculture in the form of Nutrien (NTR)), the Pandemic Portfolio has returned an outstanding +10.44% at the halfway mark in comparison with the Speculation in Play at +5.87%, Investments in Play at +5.48%, and S&P 500 at +5.19%.

What a testament to the power of true diversification! I’m in awe!

Keep reading with a 7-day free trial

Subscribe to Get Irked - Teaching Long-Term Investing Success to keep reading this post and get 7 days of free access to the full post archives.