"It's the End of the World as We Know It," and I Buy Stocks... Portfolio

Plus, Irk's Shopping List for his 60+ Individual Stocks! | Issue #36

Welcome to my breakdown of my third and final non-public ETF portfolio, what I like to call my End of the World Portfolio. Where as my i401(k) is my “Dumb Money” Portfolio which adds every Friday regardless and my Retirement ETF Portfolio buys at critical price points but can never sell, my End of the Portfolio is designed to have a lot of cash on the sidelines in the event of a Black Swan Event… in other words, a situation where market participants think the world is ending.

So, with that, let’s talk about planning for the zombie apocalypse, an asteroid collision, and nuclear annihilation!

What’s the investment strategy for this account?

Buying in Stages and Selling in Stages: The End of the World Portfolio is the one most closely akin to my three publicly traded stock portfolios: my Speculation in Play, Pandemic Portfolio, and flagship Investments in Play portfolio. Accordingly, this ETF portfolio adds in stages at critical buy targets and trims positions when they reach new all-time highs or previous points of resistance.

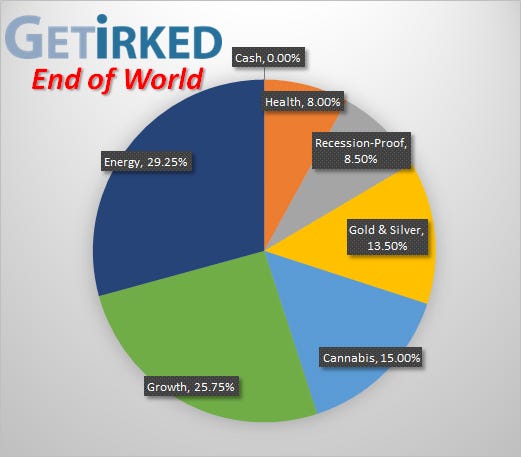

End of the World Portfolio Allocation Targets

Whereas my other two ETF portfolios seek to have diversified exposure to a wide swath of the investment world, this portfolio is targeting more specific goals. While I do want some exposure to growth and technology stocks, the goal of this portfolio is focusing on long-term narratives that some may consider more bearish:

Energy Crisis (29.25%): The need for fossil fuels as well as the expansion into nuclear energy in order to meet the ever-increasing energy demands of the world. However, I’m not just investing in traditional energy sources like fossil fuels. I’m also adding exposure to clean energy sources such as wind and solar as well as battery solutions like lithium.

Here’s the breakdown:ICLN (3.00%): The iShares Global Energy ETF seeks to encapsulate a wide swath of alternative-energy solutions including solar, wind, and even water solutions such as trying to harvest the power of the tides.

LIT (2.50%): The Global X Lithium & Battery Tech ETF does exactly what the name implies: it tries to provide an investing snapshot of the entire lithium industry including exposure to the underlying commodity as well as the companies who mine it and the ones further down the food chain who make lithium into products.

TAN (3.00%): Unlike iShares’ ICLN, Invesco’s Solar ETF focuses entirely on solar energy solutions which I still believe in for the long term as part of a non-base-load energy solution.

URA (7.50%): The Global X Uranium ETF provides exposure to the entire uranium sector. Not only does URA contain the miners and refiners, investors also get exposure to the Sprott Uranium Trust (SRUUF) which goes into the open market to buy and hold physical yellow-cake uranium.

URNJ (7.50%): A far more volatile and potentially lucrative play on uranium, the Sprott Junior Uranium Miners ETF focuses on some of the smallest players in nuclear energy. Therefore, this one is only for investors with a huge risk appetite. There’s potentially huge reward in this ETF but also huge downside risk if everything goes tits-up for the sector.

VDE (5.75%): The Vanguard Energy ETF provides exposure to the more traditional oil and gas plays, however I wouldn’t be surprised if this ETF evolves over time to include alternative energy sources and nuclear, too.

Growth & Tech (25.75%): Okay, so maybe this is more obvious, but who doesn’t want exposure to growth and technology stocks in any portfolio?

CIBR (7.25%): Rather than have to pick one or two players in the cybersecurity space, this portfolio uses First Trust’s Cybersecurity ETF to capture the widest exposure to the entire sector.

VGT (8.25%): The Vanguard Technology ETF is your traditional ETF: it seeks to provide a broad exposure to tech-minded Nasdaq stocks.

VOOG (10.25%): The Vanguard S&P 500 Growth ETF picks the highest-growing stocks in the S&P 500 and puts them in an ETF. Unlike VGT which focuses solely on tech, VOOG also includes stocks from medical technology, biopharmaceuticals, and a wide variety of other high-growth sectors.

Cannabis (15.00%): Yes, I’m one of those crazies. I believe that the legalization of recreational cannabis on the Federal level is all but inevitable, and, at the very least, I believe the Federal government will allow this sector to obtain bank accounts, credit cards, and be able to deduct business expenses. The latter alone could cause explosive growth potential in this sector.

CNBS and MSOS (7.50% each): With even cannabis ETFs going under, I represent the cannabis sector with equal positions in two of the remaining leading ETFs: the Amplify Seymour Cannabis ETF (CNBS) and the AdvisorShares Pure U.S. Cannabis ETF (MSOS). For most investors, these ETFs are the easiest way to destroy your long-term returns, so take that in mind. Only the crazies (like me) invest in this sector with any weight.

Gold & Silver (13.50%): The de-dollarization of the globe combined with inevitable government spending in the United States makes this play pretty obvious. Gold and silver have proven to retain value over thousands of years and given that I have huge Bitcoin exposure in my Retirement ETF Portfolio, I felt increased exposure to precious metals here was prudent.

PHYS Physical Gold (7.50%): The biggest holding in this part of the portfolio is naturally going to be the underlying asset itself. The Sprott Physical Gold Trust buys physical gold and holds it. It’s really that simple.

DC, EQX, GDXJ Junior Goldminers (0.75%, 0.75%, 0.75%): Dakota Gold (DC) and Equinox (EQX) are my two long-running junior gold mining plays. I also hold equal-weight exposure through VanEck’s Junior Gold Miners ETF (GDXJ).

GDX, NEM Senior Goldminers (0.75%, 1.50%): In this portfolio, I only hold one individual senior goldminer, Newmont Mining (NEM), as an offset to my large Barrick Gold (GOLD) position over in my Pandemic Portfolio. I’ve also thrown a bit of VanEck’s Senior Gold Miners ETF (GDX) into this part of the portfolio for the giggles.

SLVP Silverminers (1.00%): What precious metals exposure would be complete without exposure to the hated silver metal… well, silver? I probably should have opted for the silver ETF (SLV) like I hold in my Pandemic Portfolio, but I stupidly opened a position in the far more volatile and far underperforming miners using the iShares Global Silver Miners Fund, instead.

Recession-Proof (8.50%): Just in case the Bears who have been pounding the Recession Table for years now ever turn out to be right, I wouldn’t mind having exposure to sectors that are known for being “recession-proof".”

VDC Consumer Staples (4.50%): Boring and exactly what you might expect, the Vanguard Consumer Staples ETF holds shares of Coca-Cola (KO), Pepsico (PEP), General Mills (GIS), Heinz (HNZ), and some of the other dullest companies on the planet. Don’t knock it, though. When we do have a recession, consumers still need to eat and wipe their butts.

VPU Utilities (4.00%): While many think energy producers, waste management, and water companies are boring, last year proved there’s a lot of potential movement in the utilities space thanks to Artificial Intelligence (AI) and cryptocurrency mining having seemingly limitless appetites for energy.

Healthcare (8.00%): With obesity, cancer, and potential pandemics plaguing the world’s population, I believe that both healthcare and technological advancements in health will continue to major themes in the future.

VHT Healthcare (8.00%): When an investor wants broad exposure to health-related names, it hardly comes simpler than just buying the Vanguard Health Care ETF. To give you an idea of exactly how broad-based this ETF really is, its top ten holdings are Eli Lilly (LLY), UnitedHealth (UNH), AbbVie (ABBV), Johnson & Johnson (JNJ), Merck (MRK), Abbot Laboratories (ABT), Thermo Fisher Scientific (TMO), Intuitive Surgical (ISRG), Danaher (DHR), and Amgen (AMGN). In my humble opinion, there’s no easier way to get exposure to the entire healthcare space than VHT.

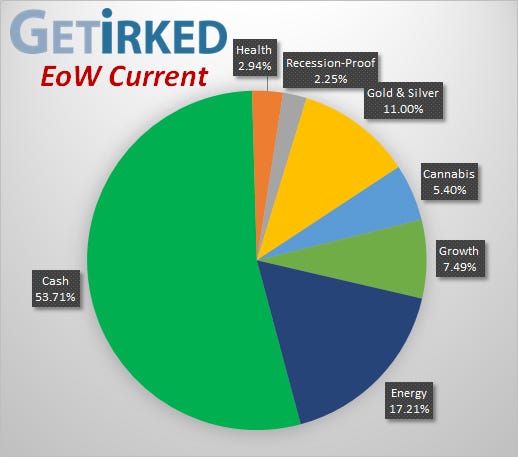

End of the World Portfolio Current Allocation

As you might expect, there’s no point in having a portfolio specifically-designed to buy during a Black Swan Event if it’s mostly invested. Accordingly, the majority of the portfolio (53.71%) is held in cash earning a healthy 4.00% risk-free yield while we wait for a big enough pullback to start triggering positions.

Make no mistake: this portfolio won’t wait for an epic pullback to start putting money to work. Just like every single one of my portfolios, it will take advantage of even small buying opportunities.

However, unlike the Retirement ETF Portfolio which seeks to have less than 10% (and preferably less than 5%) cash on the sidelines, I have no problem earning the safe return of interest while I wait more tempting buying opportunities.

Up Next: The Whole Enchilada… Portfolio!

Now that we’ve covered every single one of my non-public portfolios, next week’s update will put everything together. My entire investment portfolio is represented by six individual portfolios:

The speculative Speculation in Play

The conservative Pandemic Portfolio

The flagship Investments in Play

The “Dumb Money” i401(k)

The Retirement ETF Portfolio

The End of the World portfolio

However, that doesn’t say anything in terms of how much of each portfolio makes up my total investing net worth. What does everything look like in terms of the entire picture?

Stay tuned for next week’s issue as I delve into the total portfolio breakdown!

My Individual Stock Buy & Sell Targets

Premium Members: Read on to find my shopping list for each of my 60+ individual stock positions across my three publicly-traded portfolios: Speculation in Play, the Pandemic Portfolio, and, my flagship portfolio: Investments in Play.

Keep reading with a 7-day free trial

Subscribe to Get Irked - Teaching Long-Term Investing Success to keep reading this post and get 7 days of free access to the full post archives.